Although Apple Card is easy to use, people like to use third-party apps on iOS devices to send and receive money. This peer-to-peer money transfer ensures quick and secure transactions between you and your friends or family members. The best thing is you are not supposed to share your bank details. Do you want to use any such app? Check this list of the best money transfer apps for iPhone and iPad.

1. Venmo

Venmo is arguably the most popular app when it comes to money transfer. The app helps you everywhere you need to pay or receive money. Apart from small transactions between friends and roomies, you can use the shop with your Venmo balance wherever Mastercard is accepted.

Young users like to split the cost of meals, rents, or charge of concert tickets. College-goers also send money to their friends to wish them luck for exams or some bucks to buy birthday gifts.

Venmo developers have joined hands with other utility services like Uber, StockX, Grubhub, and Zola. Therefore, you can quickly make payment for the services you have used.

Price: Free

Download

2. WhatsApp

Unarguably the most preferred app for secure communication, WhatsApp has other surprises up its sleeve. By using your iPhone or iPad’s Internet connection (including Wi-Fi), you can send and receive money in a simple and reliable manner.

Before you start with the procedure, update this app to its latest version. Apart from transferring money, this chat client also allows you to add a new bank account.

Ask the recipient to set up WhatsApp Payment, so that you can send money, and they can receive it.

Price: Free

Download

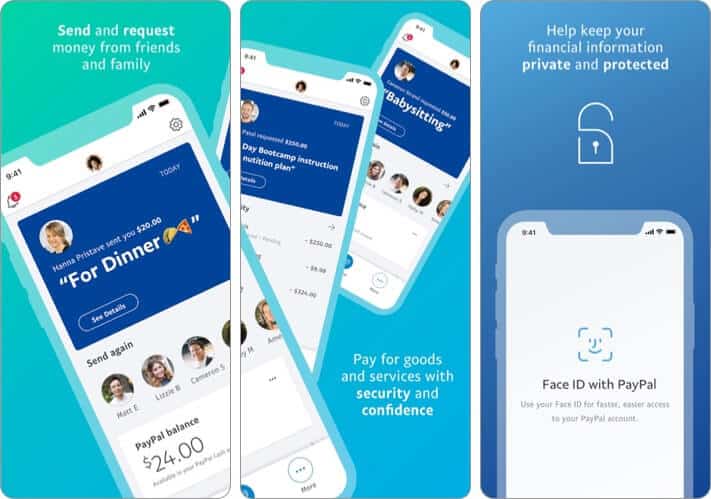

3. PayPal: Mobile Cash

PayPal can actually be considered the mother of all apps that can transfer money online. It is one of the oldest international money transfer app. The app has been used by millions of users; business owners have always used this app to send money to freelancers across the globe.

If you ask me why PayPal is popular, there are some reasons. This app keeps your financial information private and secure. For your peace of mind, PayPal helps you monitor your transaction round the clock.

Secure encryption technology, fraud protection, and authentication (fingerprint and two-factor) add an extra layer of security to your money.

Price: Free

Download

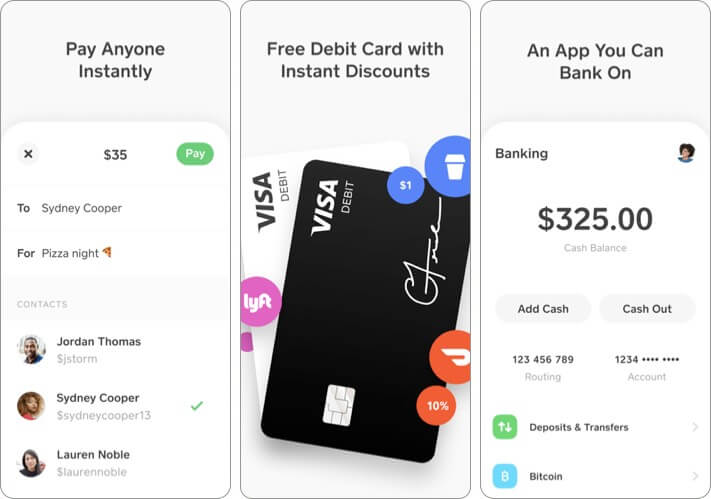

4. Cash App

Safe, fast, and free! Cash App is one of the easiest ways to transfer money internationally. ON your iPhone and iPad, you can create a security wall by using your Face ID, Touch ID, or passcode. Moreover, you can pause spending on your Cash Card with a single tap if you misplaced it.

Cash App gives you a free virtual Visa debit card in a jiffy. And within a week, you will get a custom physical debit card for free. A super-fast signup process enables you for your first payment.

Apart from money transfer, this app helps you in depositing your paychecks, tax refunds, and more. A single account and routing number can be used to pay bills from your Cash App.

Price: Free

Download

5. Western Union

Before you send money to your friend living in a different country, you can check exchange rates. Next, quickly repeat transfers. This is the power of Western Union money transfer iPhone app.

Western Union is spread across the length and breadth of this world, and therefore, it is easy to find locations of agents. You can use your card or initiate money transfer and complete the payment in cash at a nearby agent location.

As mentioned above, Western Union has its presence in more than 200 countries and territories with over 500,000 locations. You can ask your friends or family to collect cash from the physical locations. Alternatively, they can receive money in their bank account or mobile wallet.

Price: Free

Download

6. Zelle

Zelle has joined hands with leading banks and credit card companies in the United States. And this partnership ensures a fast, safe, and easy way to send and receive money.

Like Google Pay (in the list below), Zelle believes in transferring money from bank account to bank account. If your bank or credit card company has Zelle in their kitty, you can use it from your mobile banking app.

Instead of bank account numbers, Zelle uses email address or US mobile number of recipients, and send money in the safest way. The icing on the cake is Zelle does not charge a single penny to use this service.

Price: Free

Download

7. TransferWise

TransferWise is immensely popular among business owners and freelancers as it allows to send and receive money in 28 currencies. In comparison with other banks, this app is eight times cheaper to send money abroad.

The app also offers a free multi-currency account; you can hold your money and convert it when the conversion rate is high. Apart from money transfer, people love to use TransferWise to pay monthly utility bills even in another country.

Use this app to pay off your mortgage or loan abroad, and hold your money in more than 40 currencies.

Price: Free

Download

8. Xoom Money Transfer

Here’s an app by PayPal that offers a fast and secure way to send money directly to banks and cash pick-up locations across the world. It has the amazing ability to recharge phone credit and pay utility bills in other countries from your iPhone. This makes it super convenient for travel.

Further, you don’t need to worry about your transaction status because the app sends timely text updates and gives you access to customer support in multiple languages. Although the exchange rates can be a bit on the higher end, it’s worth it when you need a quick way of transferring money abroad.

Price: Free

Download

That’s all folks!

Signing off

Whether you want to transfer money within your country or internationally, you can use the above money transfer apps for iPhone. Security is your prime concern, and therefore, we have curated apps based on their popularity and usefulness.

You would like to read these posts as well:

- Personal Finance Apps for iPhone and iPad

- Tax Software for Mac

- Payroll Management iPhone and iPad Apps

- Perfect Student Loan Management App!

Which money transfer app would you like to use on your iPhone or iPad? Would you like to suggest any app? Share your feedback with us in the Comments section below.